DEX'S PRICE TRIGGER REPORT-10/19/2025

THE WEEKLY SNAPSHOT

WILL THERE BE BLOOD IN THE STREETS ON MONDAY?

Stock Market Report: October 17, 2025

Executive Summary

On Friday, October 17, 2025, U.S. stock markets concluded a volatile week on a positive note, with major indices posting modest gains amid easing concerns over bank credit practices and U.S.-China trade tensions. The session reflected investor optimism heading into a busy earnings season, though global markets largely declined and oil prices stabilized after recent fluctuations.

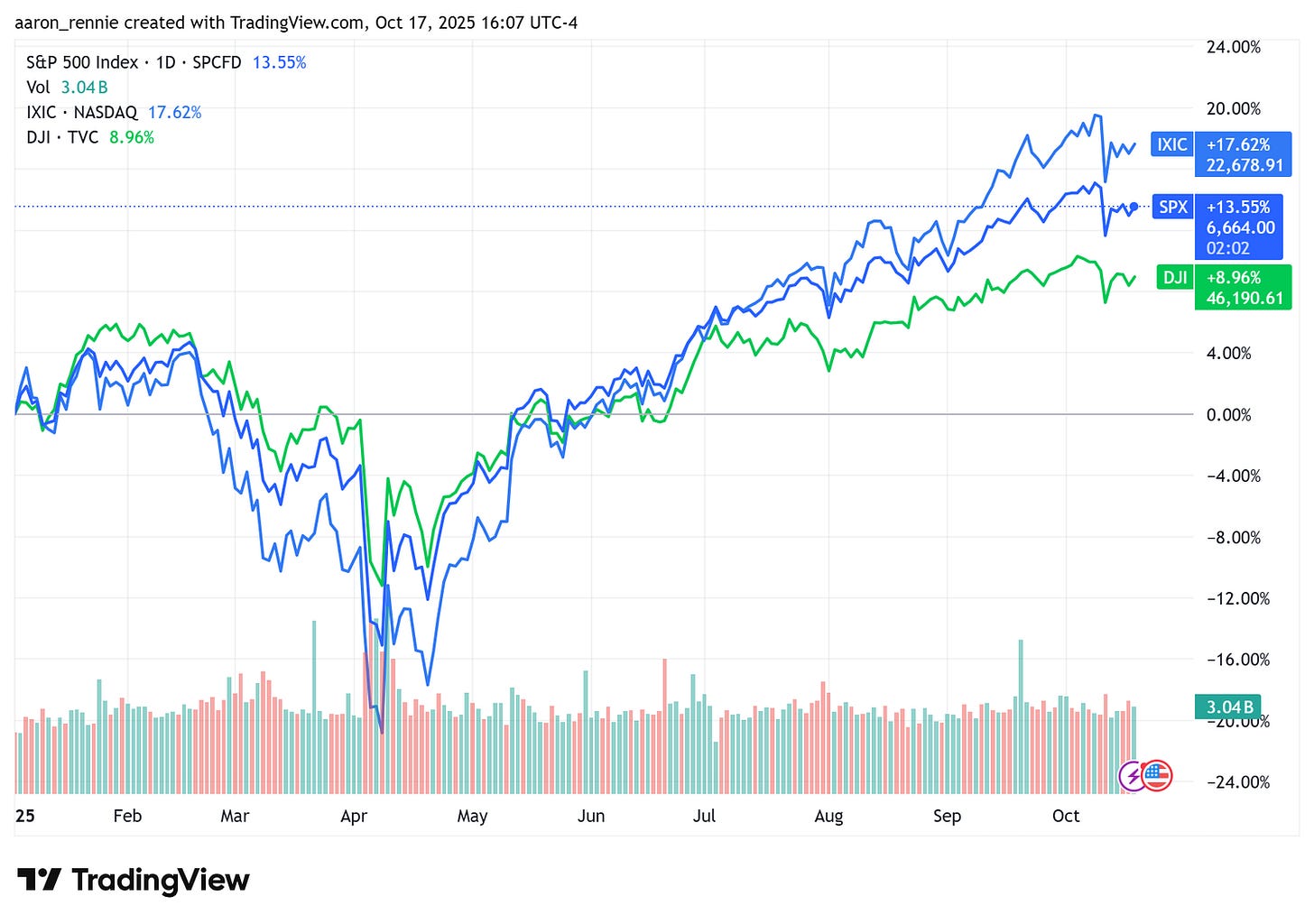

Year-to-Date Performance of Major U.S. Indices as of October 17, 2025

Performance of Major Indices

The day’s trading saw balanced gains across key benchmarks:

Dow Jones Industrial Average: 46,190.61+238.37 points+0.5%+1.6%

S&P 500: 6,664.00 (approx., based on YTD chart)+34.94 points+0.5%

Nasdaq Composite: +0.5%+2.1%

These gains capped a week of ups and downs, with the Nasdaq leading weekly performance amid strength in technology stocks. Year-to-date, the S&P 500 was up approximately 13.55%, the Nasdaq 17.62%, and the Dow 8.96%, highlighting continued resilience in equities despite economic uncertainties.

Key Market Influences

Easing Economic Concerns: Investor sentiment improved as worries about banking sector credit practices and potential U.S.-China trade escalations subsided. Former President Trump’s comments on resuming China talks contributed to the positive close.

Commodity Movements: Gold retreated slightly after reaching a new record high, while oil prices held steady, providing a stable backdrop for equities.

Upcoming Catalysts: Markets are bracing for next week’s earnings from heavyweights like Tesla and Netflix, alongside a delayed CPI report that could influence Federal Reserve policy expectations. Forecasts suggest 2025 earnings growth around 10.5%, accelerating to 13% in 2026.

Notable Stock Movements

Tesla (TSLA): Shares rose about 5% in anticipation of quarterly earnings, boosting the Nasdaq’s performance.

Sector highlights included gains in technology and consumer discretionary, while financials recovered from earlier pressures.

Social Media and Investor Sentiment

On X (formerly Twitter), discussions around the day’s market were mixed, with some users celebrating successful trades and others drawing historical parallels to past market cycles, such as comparisons to 1929. Posts highlighted optimism in individual stock picking and asset allocation, alongside cautions about emotional trading. Crypto influences occasionally overlapped with stock commentary, reflecting broader market interconnections.

Outlook

Looking ahead, the market’s resilience suggests potential for continued gains if earnings deliver positively, though volatility may persist with geopolitical and economic data on the horizon. Investors should monitor tech sector reports closely for directional cues.